Description

Meeting Agenda:

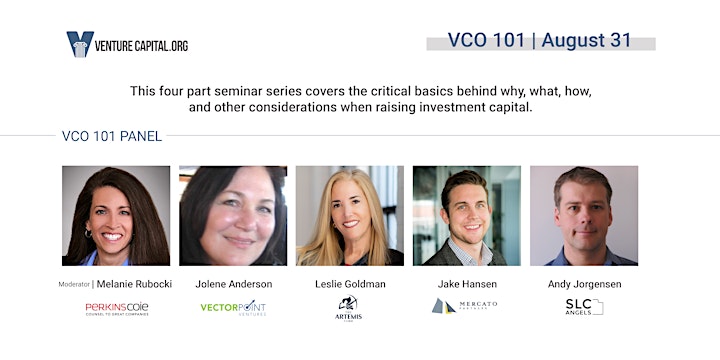

11:00 am - 11:10 am Welcome

11:10 am - 12:00 pm Panel presentation and discussion

12:00 pm - 12:15 pm Q&A

12:15 pm - 1:00 pm Virtual Networking

August 31st, 2022 Meeting Agenda:

This seminar will cover what are angel investors, venture capitalists, and family office investors. Sub-topics will include:

- What are angel investors, venture capitalists, and family office investors?

- What are accelerators and venture studios?

- How are they different and how are they alike?

- How do they get paid back or are incentivized?

- Where the investment capital comes from?

- What types of companies they invest in?

- What are the different stages of investment capital?

- Is it right for your company?

- How do I access investors? What resources exist to help me along the way

- What recommendation do you have in developing warm leads

Moderator: Melanie Rubocki (Perkins Coie)

Panelists: Jolene Anderson (VectorPoint Ventures) | Leslie Goldman (Artemis Ventures) | Jake Hansen (Mercato Partners) | Andy Jorgensen (SLC Angels)

September 28th, 2022 Meeting Agenda:

This seminar will cover investor jargon: common terms and definitions. Sub-topics will include:

- What is a general solicitation?

- What does an accredited investor?

- What is a LP and GP in a venture fund?

- What are SPV’s? What is a SAFT?

- What are some of the differences between a SAFE, convertible note, revenue financing, factoring, and priced round?

- What is a seed round, Series A, Series B?

- What are the differences between founders stock, common stock, preferred stock?

- What is post money, premoney valuation? How do you calculate it?

- What is a valuation cap and valuation discount?

- What is a cap table?

- What is dilution?

November 29th Meeting Agenda Finding the Right Investor:

This seminar will cover what are angel investors, venture capitalists, and family office investors. Sub-topics will include:

- How do I find an investor that is right for me?

- How do I know if I am approaching the right investors at the appropriate stage?

- What type of advisor should I look for so I don’t get ripped off

- How do I do due diligence on my investor

October 25th, 2022 Meeting Agenda Navigating Term Sheets:

This seminar will cover what are angel investors, venture capitalists, and family office investors. Sub-topics will include:

- What is a convertible note, SAFE Agreement, and priced round? How do they work and how are they different?

- What is a term sheet?

- How is valuation calculated? What is the difference between premoney and postmoney valuation?

- What are economic deal terms compared to control terms?

- What is preferred equity and how does it compare to common equity?

- How do liquidity preferences work and how are is it triggered?

- What are stock options and warrant coverage?

- How do stock options/warrant coverage impact founder equity if executed/not executed?

- What is dilution? Why is it important? How do I calculate it?